About Owner Operator Direct

Jacksonville, FL, USA

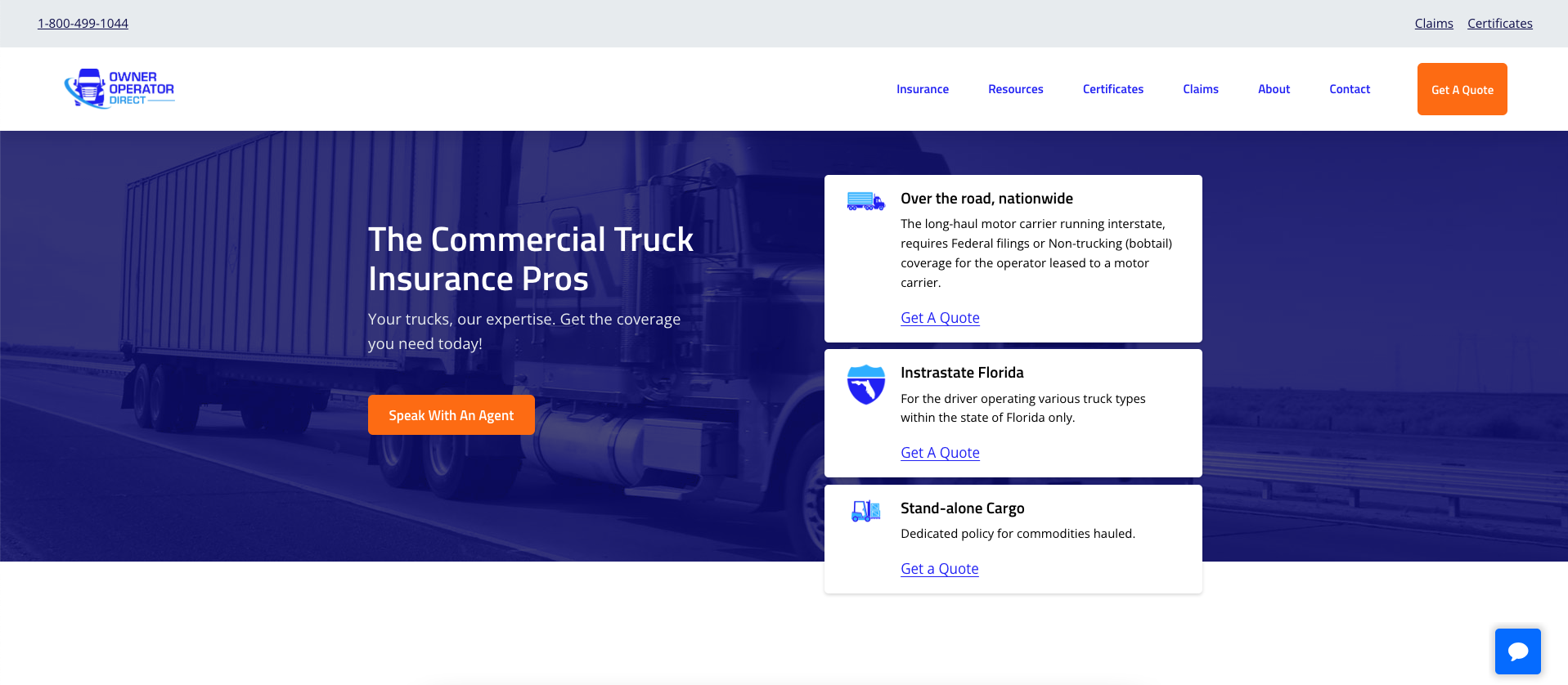

Owner Operator Direct (OOD) positions itself as a specialist within the insurance landscape for truckers—an industry that's as complex and varied as the cargo these road warriors haul. With a clear focus on owner-operators, OOD brings a tailored experience to the table, partnering with Lancer Insurance Company to back its offerings. This strategic partnership is pivotal, offering a stable foundation for a suite of services ranging from auto liability to cargo coverage.

What sets OOD apart is its educational approach. In an industry riddled with intricacies, OOD prides itself on demystifying insurance and risk for truckers. This educational bent is a boon for independent operators who may not have the backing of large firms' resources but still need to navigate the treacherous waters of liability and coverage. It's a thoughtful addition that likely resonates with truckers who are keen on understanding the nuances of their policies rather than just being sold a product.

OOD's commitment to service is evident in their user-friendly online presence. Their promise of 24/7 access to certificates of insurance and a finance charge-free monthly payment option reflects an understanding of the truckers' on-the-go lifestyle. It's these practical touches that suggest OOD isn't just about selling insurance; they're about crafting a service experience that aligns with the realities of the road.

In terms of coverage, OOD doesn't shy away from boasting a more comprehensive package than standard policies. Features like expanded refrigeration coverage and a separate limit for debris and pollution removal indicate a depth of coverage that seems to anticipate the specific challenges faced by truckers. For an owner-operator seeking peace of mind, such details are likely to tip the scales.

However, it's worth noting that the insurance game, especially in the trucking niche, is highly competitive. OOD's offerings, while robust, are part of a larger market with many players. What might help customers lean towards OOD is their combination of coverage, educational resources, and partnership stability. This triad is crucial in an industry where risk is a constant companion.

While OOD does not flaunt its ranking, its confidence in its services suggests a company that knows its strengths and plays to them well. The absence of hard sell and the focus on education and service suggest a company that's more interested in long-term relationships than quick sales. This approach is reassuring, especially for independent operators who are not just looking for insurance but a partner in risk management.

In summary, Owner Operator Direct seems to offer a compelling package for the independent trucker. Their focus on education, their partnership with an industry leader for backing, and their comprehensive coverage options all speak to a company that understands and is prepared to meet the unique needs of the trucking world. While the market is crowded, OOD's service-centric approach might just be the differentiator that attracts those looking for more than just insurance—a partnership on the long haul.

Fast Facts

- Owner Operator Direct has been serving owner operators across America with commercial truck insurance since 2004.

- The company provides online access to certificates of insurance 24/7 and offers monthly payment options without finance charges.

- Owner Operator Direct's cargo form policy includes expanded refrigeration coverage, earned freight charges, and a catastrophic limit of $1,000,000.

- Their policy also covers debris and pollution removal with a separate limit of $25,000.

- Policyholders benefit from a combined deductible for tractor, trailer, and cargo insurance losses.

Products and Services

- Bobtail Insurance - Coverage designed specifically for when a truck is driven without a trailer, also known as 'deadheading'. This insurance is typically required for leased owner-operators.

- Liability Insurance for Commercial Vehicles - Provides protection against liability risks that truckers may encounter while operating their commercial vehicle. This is a fundamental coverage for accidents causing injury or property damage.

- Cargo Insurance - Offers broad coverage for cargo with limited exclusions, including expanded refrigeration coverage, earned freight charges, and more, catering to the varied needs of truckers hauling different types of goods.

- Physical Damage Coverage - Covers damages to the truck in case of an accident, ensuring that the owner-operator's investment in their vehicle is protected against unforeseen events on the road.

Want to learn more?

Click here to check out the rest of our rankings and reviews.