How to Strategically Budget for Trucker Insurance Companies

Understanding how to strategically budget for trucker insurance companies requires a comprehensive look into the multi-faceted nature of the trucking industry, the economic principles underlying insurance markets, as well as the intricate financial planning techniques employed by astute business enterprises. The task at hand might seem daunting at first glance, but a systematic approach with a focus on optimization can make it a manageable and rewarding endeavor.

To begin with, we need to appreciate the unique position that the trucking industry holds in the broader economic landscape. As a major lifeline for global trade and numerous other industries, the trucking business is one that capitalizes on the economic principle of comparative advantage. This involves a focus on what one can do best, and for truckers, it is the efficient movement of goods from one point to another. Trucking companies, therefore, should focus on this key strength, while outsourcing other functions such as insurance to companies that specialize in it.

From an insurance perspective, the business of providing coverage to truckers is fraught with a significant level of risk. This is mainly due to the potential for catastrophic accidents that could lead to high claim payouts. The economics of insurance dictate that high-risk scenarios generally attract high premium rates. This is a direct reflection of the well-known actuarial principle which posits that the premium charged should be proportional to the risk insured.

To strategically budget for trucker insurance, a blend of financial planning techniques and a keen understanding of the trucking business are required. A good starting point is a detailed risk assessment. This involves identifying potential risks, quantifying these risks in monetary terms, and exploring ways to mitigate them. The end goal is not necessarily to eliminate all risks - that would be an unrealistic goal - but rather to reduce them to a level that is economically manageable.

In terms of risk mitigation, there are several approaches that can be employed. For instance, trucking companies can invest in advanced driver training programs and safety technology. Such measures can potentially reduce the frequency and severity of accidents, thereby leading to lower insurance premiums.

Another key aspect of budgeting for trucker insurance is understanding the insurance market dynamics and leveraging them to your advantage. Insurance markets, like other financial markets, are subject to cycles of "soft" and "hard" markets. During a soft market, insurers compete aggressively for business, which can drive down premiums. Conversely, in a hard market, insurers are more selective in underwriting risks, leading to higher premiums. Being aware of these market cycles and timing insurance purchases accordingly can result in significant cost savings.

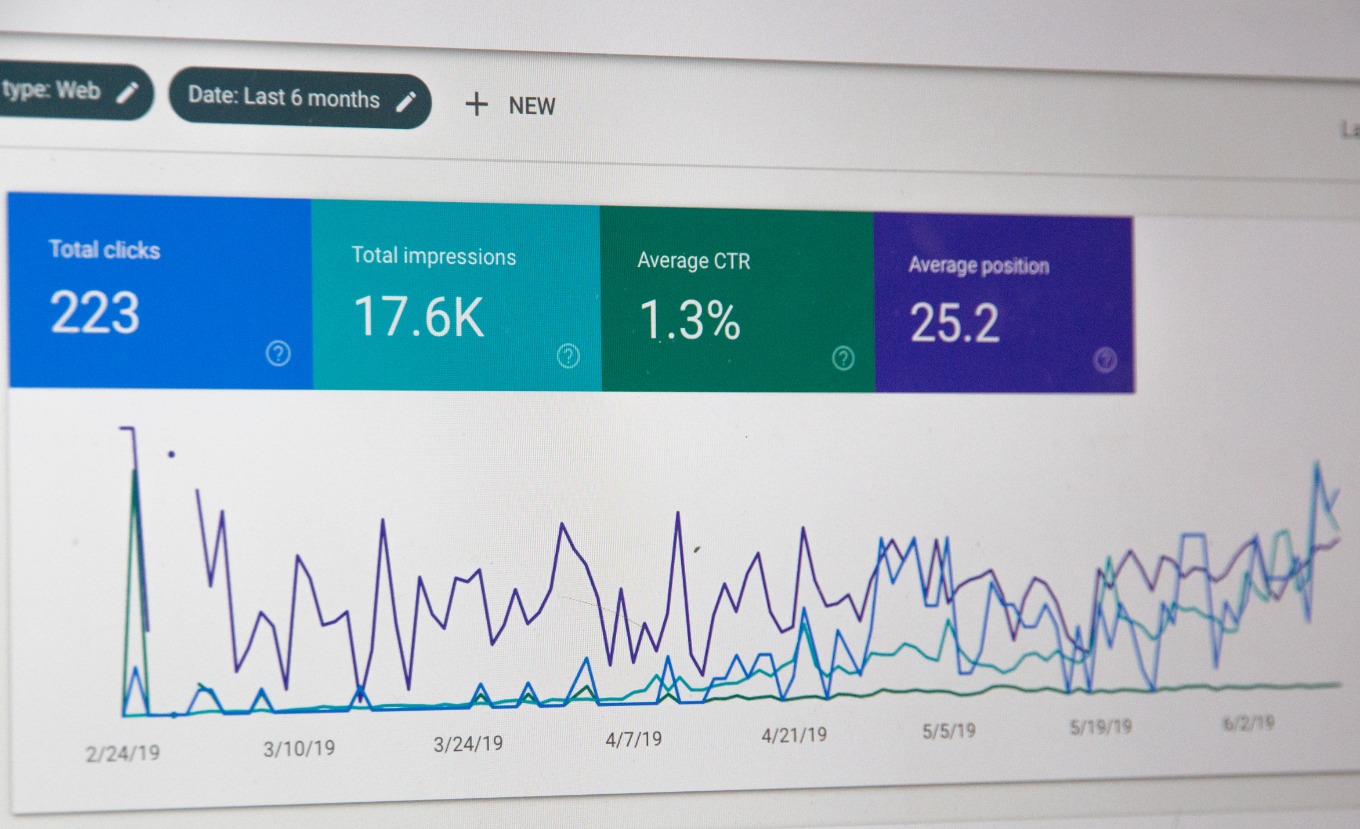

The role of data analytics in insurance budgeting cannot be overstated. By leveraging advanced data analytics techniques, trucking companies can gain insights into their risk profile and insurance needs. This, in turn, can guide negotiations with insurers and help secure the most favorable terms.

In conclusion, budgeting for trucker insurance calls for a strategic approach that combines knowledge of the trucking industry, understanding of the economics of insurance, and the application of advanced financial planning techniques. This might require a significant investment of time and resources, but the potential benefits in terms of cost savings and risk management make it a worthwhile pursuit.

It's important to remember that every trucking business is unique, and there is no one-size-fits-all approach to this challenge. Therefore, while the principles outlined here provide a general roadmap, each company must tailor their strategy to fit their specific circumstances and needs.

Lastly, it is crucial to keep things in perspective and remember the ultimate goal – providing the best possible service to clients in a sustainable and profitable manner. After all, insurance is just one of the many costs of doing business, and while it is important to manage it effectively, it should not overshadow the core operations of the trucking business.

Understanding how to strategically budget for trucker insurance companies requires a comprehensive look into the multi-faceted nature of the trucking industry, the economic principles underlying insurance markets, as well as the intricate financial planning techniques employed by astute business enterprises.